georgia ad valorem tax 2021

DEKALB STONE MOUNTAIN 21000. Qualified low-income building projects may be classified as a separate class of property.

How Much Are Tax Title And License Fees In Georgia Langdale Ford

If you have a lienholder.

. Sign in to TurboTax Online then click Deductions Credits Review or Edit. Mar 26 2021 1033 AM. Historical tax rates are available.

Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system. To enter your Personal Property Taxes take the following steps. March 17 2021 513 PM.

This tax is based on the value of the vehicle. For the answer to this question we consulted the Georgia Department of Revenue. Motor Vehicle Tag Title Fees declined by nearly 64 million or -162 percent while Title Ad Valorem Tax TAVT collections.

2021 property tax bills 2021 property tax bills for the city of jasper will be mailed on friday november 12 2021. Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to expand an exemption for agricultural equipment and certain farm products held by certain entities to include entities comprising two or more family owned farm entities to. Several distinct entities are involved in.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. The TAVT rate will be lowered to 66 of the fair market value. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax.

25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4.

Georgia ad valorem tax 2021 Wednesday April 6 2022 Edit A BILL to be entitled an Act to amend Chapter 5C of Title 48 of the Official Code of Georgia Annotated relating to alternative ad valorem tax on motor vehicles so as to revise the definition of fair market value of the motor vehicle to exclude certain interest and financing charges for leased motor vehicles. DEKALB TAD - 1 KEN04 T104. If itemized deductions are also.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

DEKALB TAD - 1 KEN14 T114. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Income from retirement sources pensions and disability income is excluded up to the maximum amount allowed to be paid to an individual and his spouse under the federal Social.

Ad Valorem Tax Process For the complete official code of Georgia referred to throughout as OCGA click HERE Property is taxable in the county where it is located unless otherwise provided by law. A reduction is made for the trade-in. This calculator can estimate the tax due when you buy a vehicle.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to provide for a state-wide exemption from all ad valorem taxes for timber equipment and timber products held by timber producers. To provide for a referendum.

Other possible tax rates in Georgia include. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. The ad valorem calculator can also estimate the tax due if you transfer your vehicle to georgia from another state.

Details on Georgia HR 756 Georgia 2021-2022 Regular Session - Ad valorem tax. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

GEORGIA DEPARTMENT OF REVENUE. County District MO Bond. To provide for related matters.

You will now pay this one-time. 1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle. The Georgia County Ad Valorem Tax Digest Millage Rates have the actual millage rates for each taxing jurisdiction.

Georgia law requires each county levying and recommending authority to provide certain disclosures to taxpayers prior to the establishment of the annual millage rate for ad valorem tax purposes. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Instead it appears to be a tax in the nature of a sales tax.

To provide for effective dates. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. PTS-R006-OD2020 Georgia County Ad Valorem Tax Digest Millage RatesPage 13 of 43.

Updated April 6 2021. And a timely Order can be issued by Commissioner authorizing the billing and collection of ad valorem taxes. You can use DRIVES e-Services to determine the amount due.

The two changes that apply to most vehicle transactions are. The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. The State of Georgias net tax collections for April totaled 501 billion for an increase of 221 billion or 789 percent compared to April 2021 when net tax collections totaled 280 billion.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia.

This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. The full amount is due upon titling any motor vehicle. The Georgia title will be issued to the lienholder on file.

Thus the tax would be deductible on Schedule A of Form 1040 if you itemize as part of your state and local sales tax paid however if you choose to deduct sales tax you cannot claim the. If you are a new Georgia resident you are required to pay a one-time title ad valorem tax title tax of 3. Local state and federal government websites often end in gov.

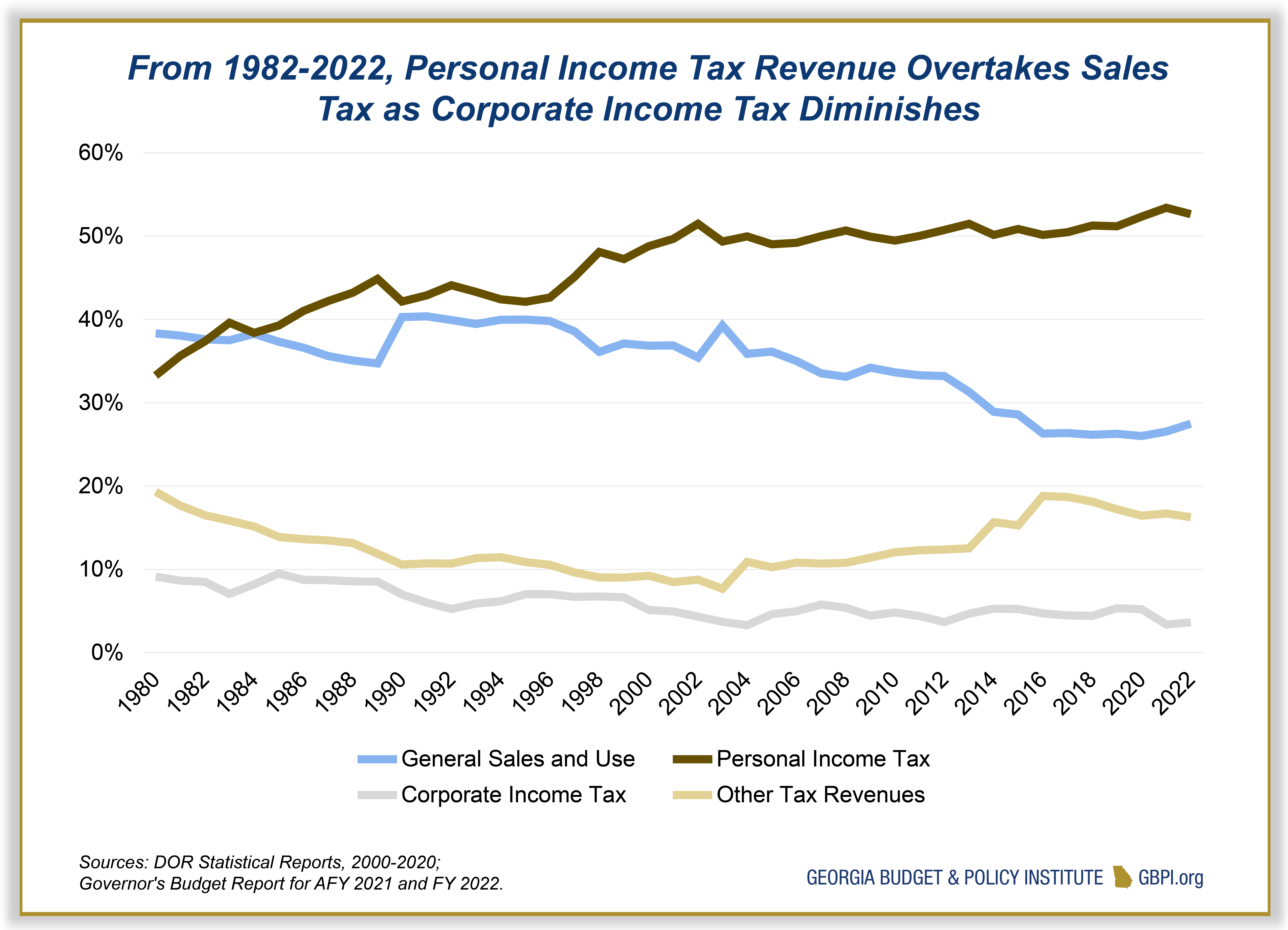

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

2021 Property Tax Bills Sent Out Cobb County Georgia

Property Overview Cobb Tax Cobb County Tax Commissioner

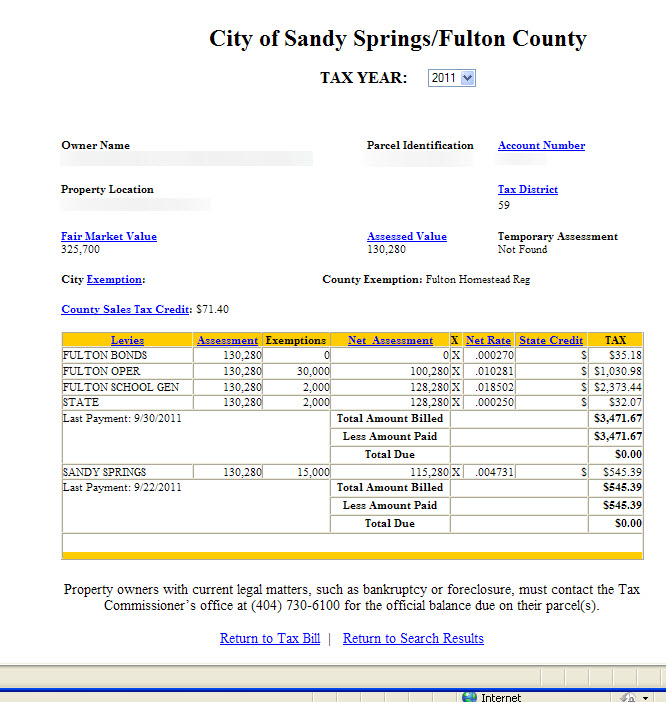

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Property Taxes Laurens County Ga

Tax Rates Gordon County Government

State Local Property Tax Collections Per Capita Tax Foundation

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

2021 Property Tax Bills Sent Out Cobb County Georgia

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions